Best Route Planning Software in 2025

This guide compares Track-POD, RouteManager, Circuit, and Upper, covering features, pricing, routing quality, and best-fit scenarios to help businesses choose the best route planning software for 2025.

Read More

Australia and New Zealand have always been logistics powerhouses, yet the last three years have pushed the bar higher than ever. Online shopping exploded, new on-demand categories appeared overnight, and customers now expect parcel-level visibility from Bondi to Bluff. Meanwhile, rising fuel costs, tougher driver-safety laws and brutal competition from global giants leave no room for manual route planning or guess-and-see dispatch tactics.

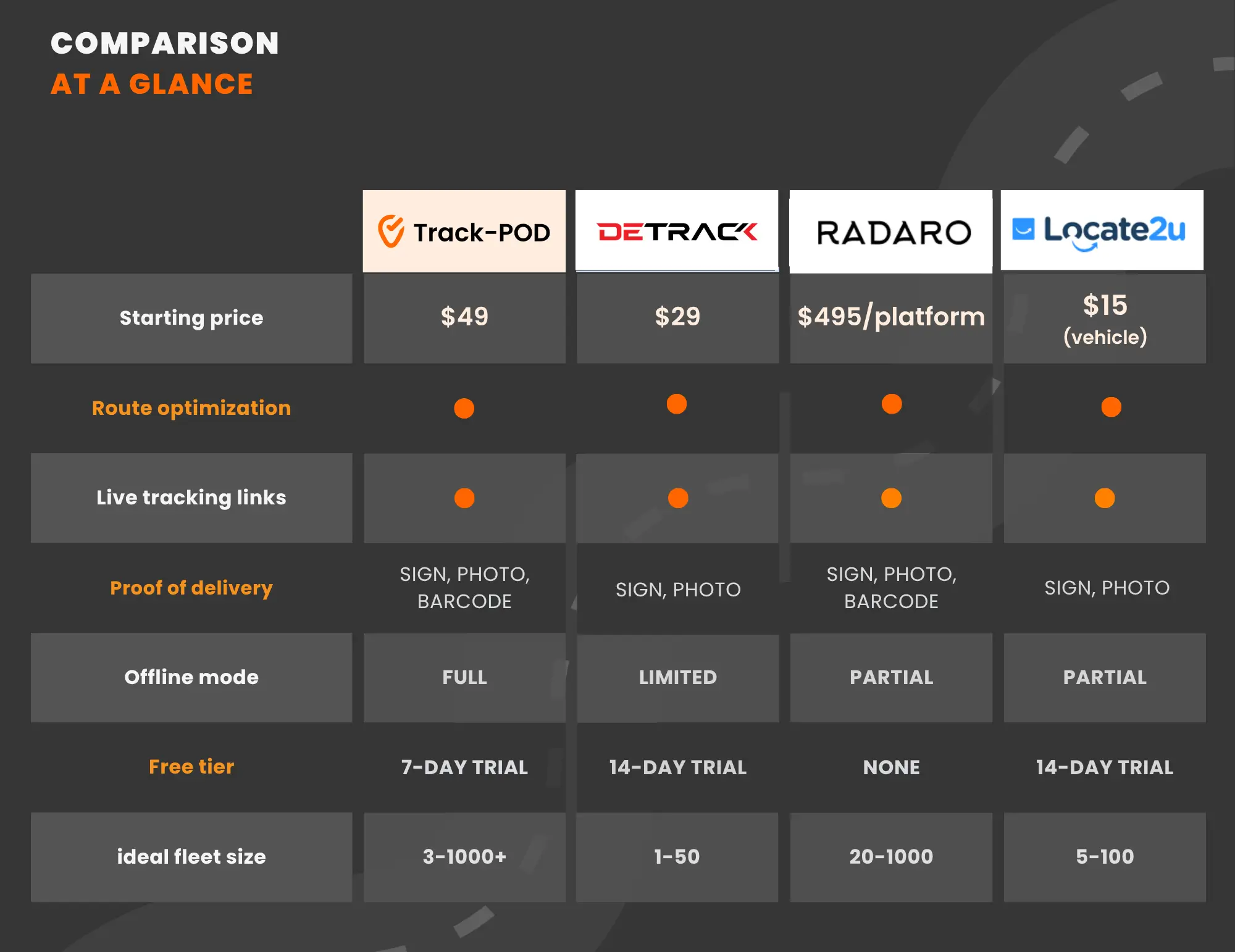

Not every tool fits every fleet though. Some businesses need a single low-cost layer to capture signatures, others need full-stack optimisation with depot balancing, barcode scanning and deep analytics. To help you sort the field, we reviewed four solutions with heavy uptake in Australia and New Zealand.

On this page

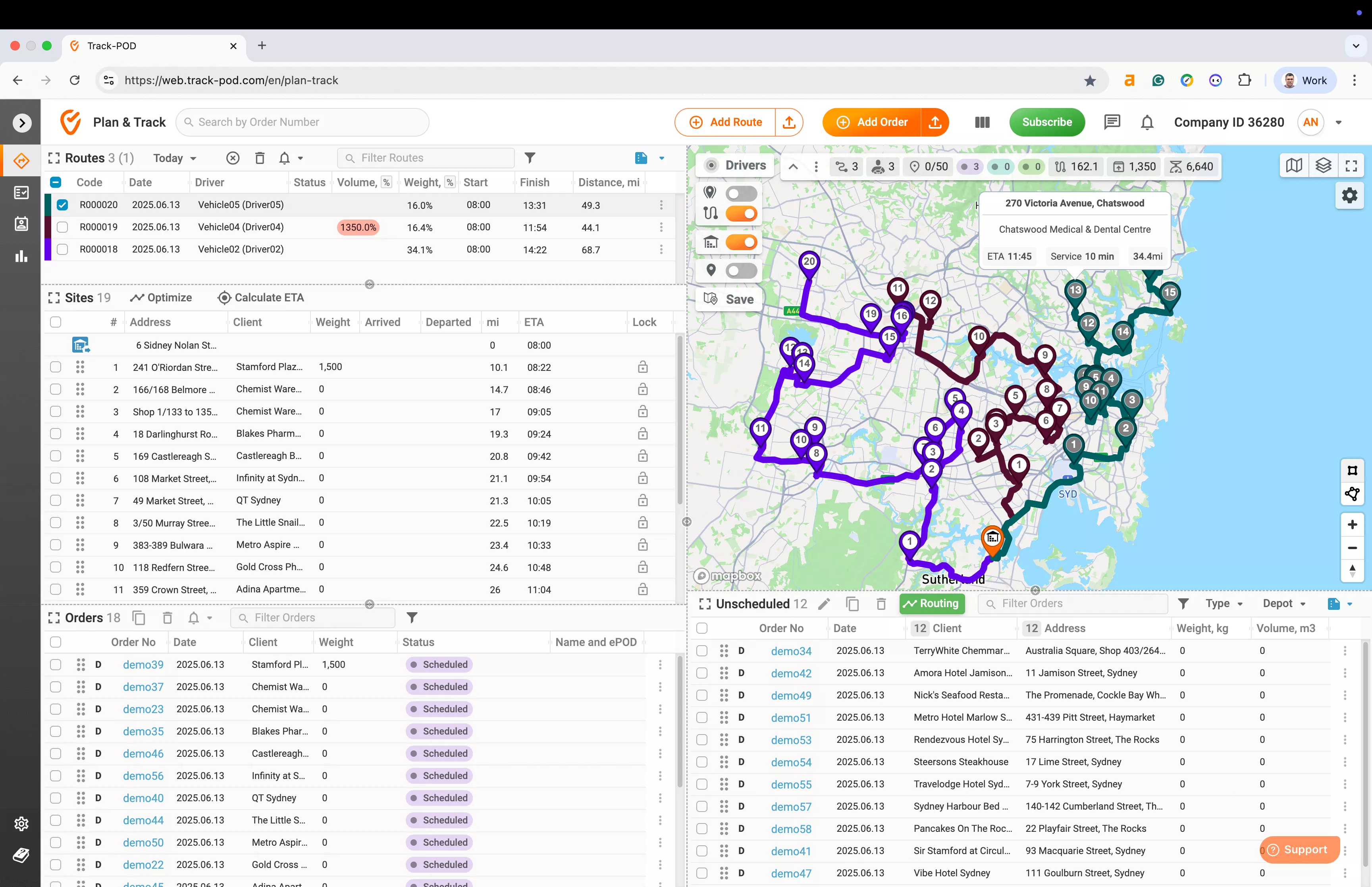

Track-POD is an enterprise-ready delivery-management suite that scales from three drivers to well over 1,000. One subscription packs route optimisation, live GPS tracking, electronic proof of delivery (ePOD), customer notifications, load checks, barcode scanning, driver chat, and deep reporting. Everything is available on day one—no hunting for paid add-ons.

Dispatchers work in a drag-and-drop web dashboard: lasso stops on a live map, bulk-edit orders, and run optimisation by time, distance, or cost. ETAs refresh every five minutes with traffic data. Drivers use a free iOS or Android app that stores data offline during blackspots (handy on rural WA highways) and syncs once reception returns.

Multi-depot route engine – Build optimised routes for dozens of warehouses, hubs, or branches in a couple of clicks. Constraints cover weight, cube, pallets, time windows, driver skills, and order priority.

Dynamic ETAs – Constant ETA refresh keeps dispatchers, customers, and drivers aligned.

Branded tracking links – Share live maps that show vehicle approach and final POD photos.

Full ePOD suite – Signatures, multi-angle photos, barcode scans, load checks, COD, and editable templates for any commodity—from tyres to flat-pack furniture.

Advanced team management – Create unlimited teams across cities or countries, each with its own drivers, dispatchers, depots, and granular permissions. A Perth warehouse can’t accidentally edit a Sydney run.

Rich analytics – At least 12 months of historical data on every plan, exportable to CSV, PDF, Power BI. Track planned vs actual kilometres, on-time percentage, and driver utilisation.

Open integrations – REST API, webhooks, Zapier, plus direct plugs to Xero, NetSuite, Odoo, Shopify, Magento, WooCommerce, QuickBooks, and more.

Vinidex – pipeline-logistics modernization – rolled out Track-POD across its nationwide distribution fleet (about 300 trucks), integrating delivery of PVC, PE, and PP pipe systems for building, infrastructure, irrigation, mining, gas, and energy projects. Real-time tracking and digital delivery confirmations replaced manual paperwork and reduced order-delivery disputes to near zero. ETA SMS/email alerts wiped out nearly all “Where is my pipe shipment?” calls.

Tyremax – multi-industry delivery efficiency – serving automotive, industrial, agricultural, forestry and mining clients, Tyremax handles complex multi-product shipments (tyres, inner tubes, repair products, accessories) with a wide distribution network. By using Track-POD, drivers can complete multiple drop-offs per run with automated manifests, signature/photos and condition checks — streamlining operations, reducing paperwork overhead, and cutting admin time significantly for the wholesale business.

All Purpose Transport – scaling with automation and transparency – as demand grew across sectors needing time-sensitive transport (express courier, refrigerated goods, heavy transport, warehousing), Track-POD allowed All Purpose to scale capacity without proportionally increasing dispatch labor. Automated ETA/SMS updates to customers, digital manifests, and live-tracking improved on-time performance metrics. The added transparency and data logging also strengthened trust with clients such as retail chains, food-service distributors, and industrial suppliers — reinforcing All Purpose’s position as Queensland’s go-to full-service transport provider.

Liquid Mix – beverage-distribution modernization — rolled out Track-POD across its wholesale beverage-delivery fleet, serving bars, pubs, restaurants, cafés, taverns, liquor stores and nightclubs across Western Australia. Real-time tracking and digital delivery confirmation replaced manual logs and paper manifests, eliminating nearly all “Where’s my order?” calls from venues awaiting beer, wine, spirits, mixers or soft drinks. Multi-stop orders — from their 7,500+ product-line catalogue — are now delivered with photo/POD proof, ensuring reliability and accountability at every handoff.

Designed for big operations – Optimises routes for dozens of depots, hundreds of vehicles, and thousands of daily stops. Handles five, ten, or thirty branches in one dashboard.

Team & permission control – Separate teams by region, brand, or contract. Set precise visibility so each dispatcher or client sees only relevant orders and metrics.

Scales in minutes – Add ten or two-hundred new drivers instantly; pricing tiers and infrastructure absorb growth without re-platforming.

Offline workflow – Drivers keep scanning and collecting POD in zero-coverage zones. Data syncs later.

Continuous improvement – Frequent updates deliver features like Android Auto/CarPlay in-cab mode, custom dashboards, and advanced CSV import rules, keeping large fleets ahead of competitors.

24 / 7 global support – Real humans on live chat cover ANZ business hours; extensive knowledge base and webinars shorten onboarding for large teams.

Learning curve – Power users love the filters and views, but new staff should budget time for tutorials.

No perpetual free tier – After the seven-day trial every vehicle requires a subscription, so micro-operators may look elsewhere.

Seven-day free trial with no credit card.

Advanced: USD 49 per driver / month (annual) – full optimisation, ePOD, tracking, analytics.

Advanced Plus: USD 69 per driver / month – up to 50 web users, unlimited orders, geofencing, and more.

All plans include the driver app, live tracking, offline POD, and unlimited users for dispatch or customer service. To learn more about the pricing, read this page.

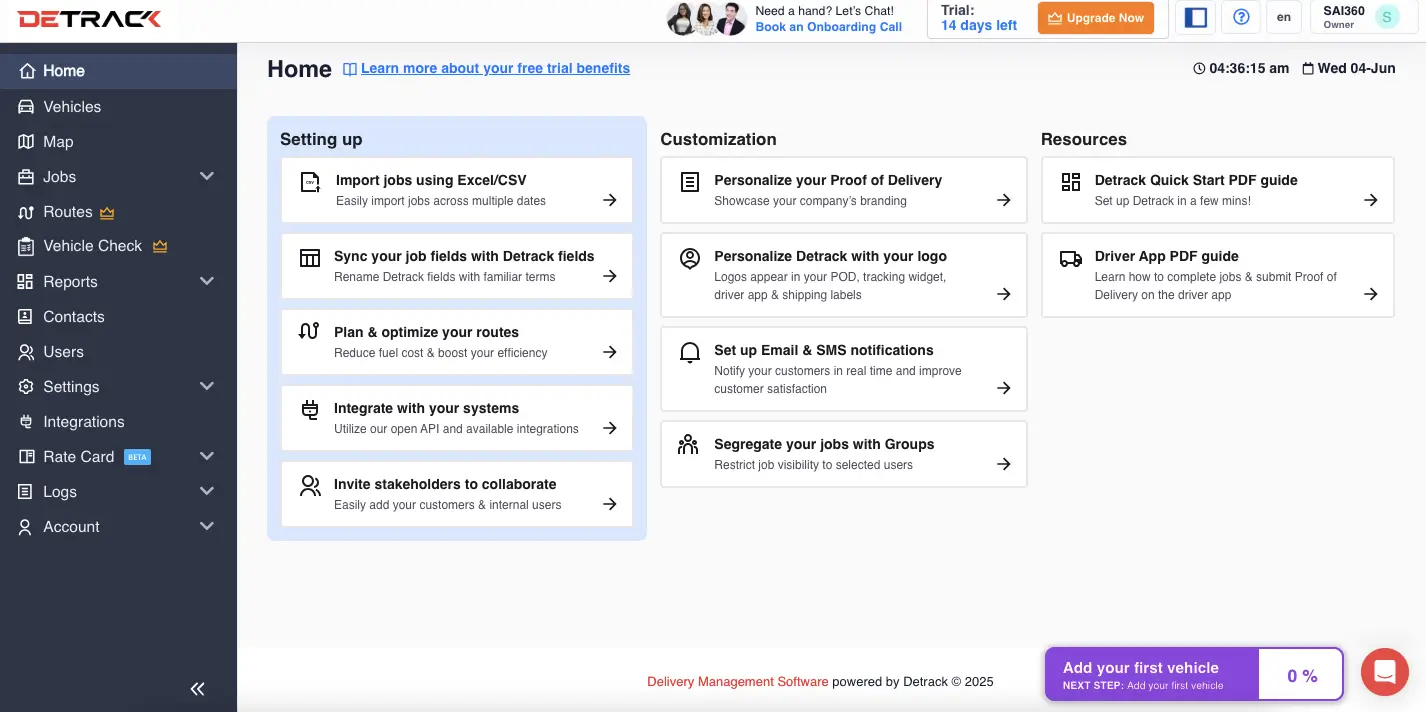

Detrack keeps things straightforward for small fleets. Sign up, load your jobs, and you’re tracking within minutes. The entry-level Pro plan starts at USD 29 per driver each month, making it one of the least expensive ways to get live GPS and electronic proof of delivery. Companies that outgrow manual sequencing can step up to the Advanced tier, which adds built-in route optimisation. For fleets with more than 100 vehicles, Detrack offers custom pricing and support.

Live map with real-time ETA texts and emails.

Photo and signature proof captured in one tap, including contact-free drops.

Unlimited viewer accounts for clients or branch managers.

Zapier and an open API pull orders from Shopify, WooCommerce, Xero and Google Sheets.

Advanced tier or ElasticRoute add-on reorders stops into the most efficient sequence.

Hobart courier: A two-van team shares GPS links and POD photos with local retailers, giving big-carrier visibility on a small-fleet budget.

Adelaide furniture depot: A missed drop triggers an instant alert; dispatch rings the customer while the crew is still kerbside, avoiding a costly second run.

Christchurch produce wholesaler: Imports a CSV manifest at dawn, assigns two trucks and emails cafés their ETAs before kitchens fire up.

Low monthly cost for small fleets: USD 29 gets unlimited jobs and five years of data history.

Clean, lightweight interface; most drivers learn it in a single shift.

Quick deployment with no complex onboarding.

Changing a route mid-shift means rebuilding the project from the ground up.

Dashboard is reliable, but feels dated: the Map is a separate screen from Routes and Jobs, and you end up clicking between them quite a bit.

Route optimisation available only on the higher-priced Advanced tier or through an external add-on.

Fourteen-day free trial on any tier.

Pro – USD 29 per driver per month (billed annually).

Advanced – USD 39 per driver per month with integrated optimisation.

Custom Fleet – Quote on request for 100+ vehicles, including dedicated support.

Detrack suits small teams that need dependable tracking and proof of delivery at a price even a start-up can handle.

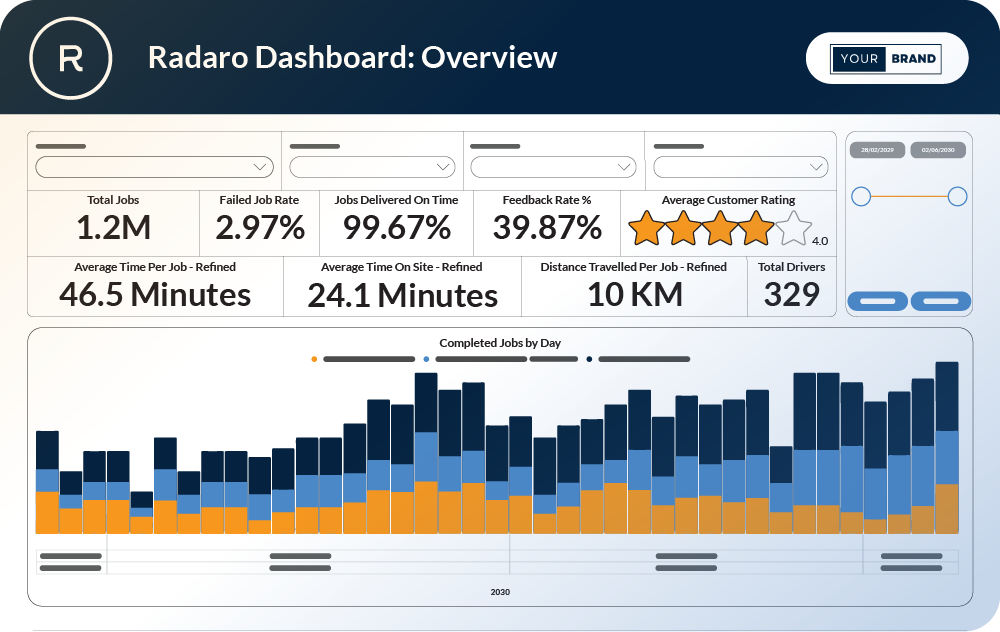

Radaro is Melbourne born and bred, designed for retailers who see delivery as part of their brand promise. It combines AI routing with a slick customer-tracking journey, detailed analytics and options like driver shift bidding. Many features echo ride-hailing UX, creating that “your driver is 3 minutes away” feel.

AI optimisation – Balances routes against service windows, traffic and historical data.

Uber-style live tracking – Map shows driver avatar, ETA ticks down in real time, reducing WISMO calls.

NPS feedback loop – Customers rate each delivery; managers review scores by driver, store or product line.

Rich POD – Unlimited photos, barcodes, serial capture, assembly notes.

Skill and shift tools – Restrict jobs by licence type, allow contractors to bid on open runs, or auto-assign jobs to nearest idle driver.

API-first – Plug straight into enterprise WMS or ERP; track sub-contractors in the same view.

Furniture and appliances – A national lounge brand adopted Radaro. Two-person crews tag jobs as “delivery only” or “delivery plus assembly.” Customers get SMS updates at key stages and leave NPS ratings.

Enterprise 3PL – A warehousing group in Sydney feeds SAP orders to Radaro. Sub-contractor vans run the Radaro app, letting HQ see every stop and automate detention fees if service times exceed contract.

Field service – Service businesses (cleaning services, mobile technicians, etc.) in NZ and Australia find Locate2u handy for managing appointments. A pest control company, for instance, could schedule all appointments in Locate2u, optimize each technician’s route, and send homeowners a tracking link when the tech is on the way. .

Premium CX – Live tracking page looks enterprise grade, raising customer perception.

Customisable – Team tweaks templates, reports and webhook flows per client.

Deep analytics – Dashboards slice performance by route, job, driver, geography and NPS trend.

Pricey – Entry tier around USD 495 monthly, billed platform first, then per driver and SMS usage.

No open trial – Sales demo required; small fleets may find barrier high.

Feature bloat for small firms – Shift bidding or complex escalation rules may overwhelm two-van operations.

No published tiers. Typical quote starts near USD 495 per month, plus usage. Demo required.

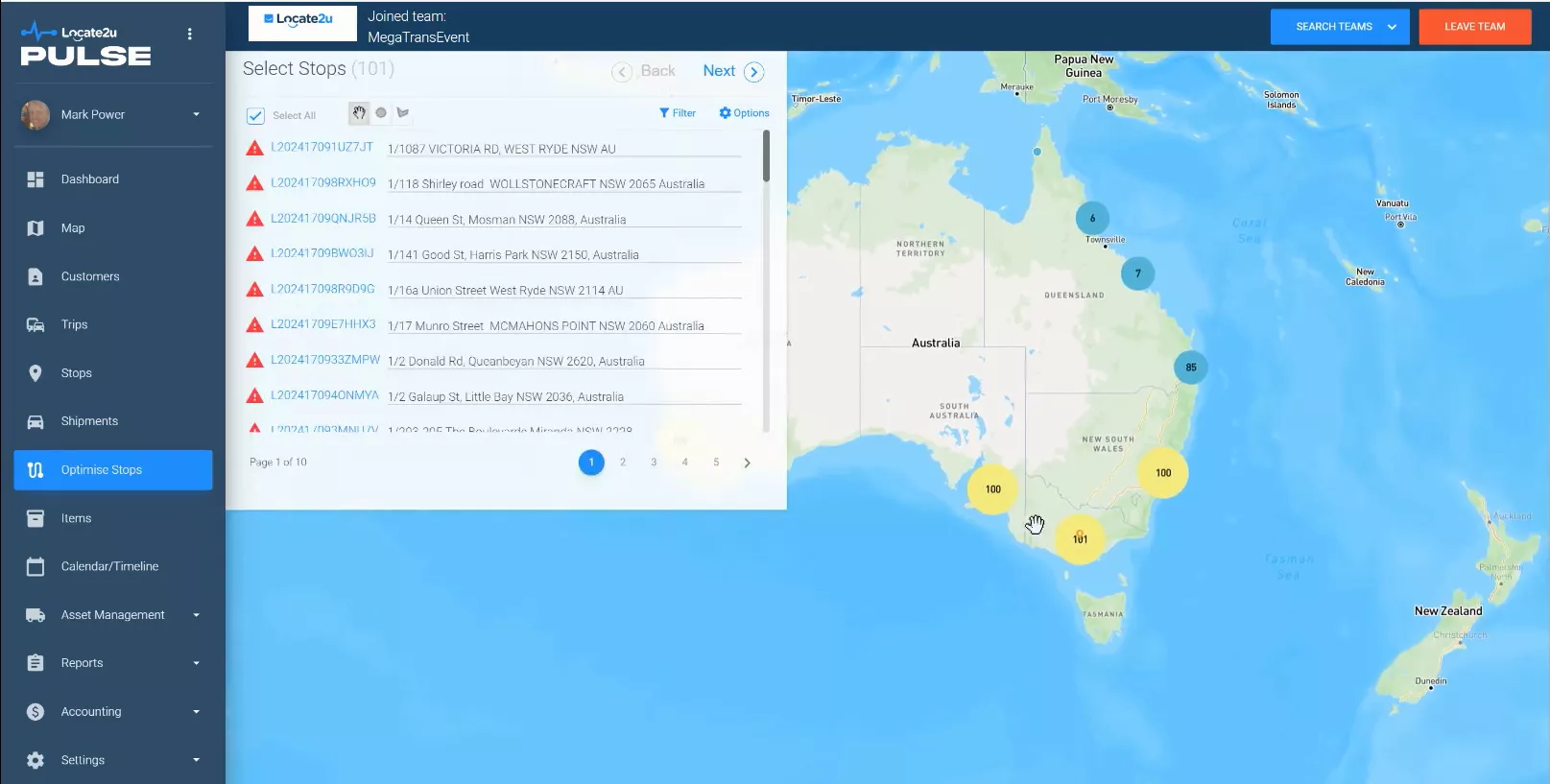

Locate2u grew out of courier marketplace Zoom2u, aimed at giving SMEs the same live-tracking polish as larger carriers. The platform bundles route optimisation, GPS tracking, bookings and simple driver scorecards. It focuses on ease: self-serve signup, clear pricing, mobile UI that any gig driver can master.

One-click optimisation – Import orders, click optimise, dispatch routes.

Live tracking SMS – Single link shows driver dot and ETA countdown.

Signature and photo POD – Lightweight workflow with optional customer rating.

Booking manager – Schedule deliveries or services, view calendar, drag bookings across drivers.

Driver behaviour metrics – Flag speeding or harsh braking events via phone sensors.

Shopify plug-in and Zapier – Orders push to Locate2u automatically.

Local retailers – A florist network in Canberra imports Shopify orders, optimises four vans, and texts brides a live link on wedding mornings.

Field services – A Christchurch pest-control firm sets daily routes, sends arrival alerts and collects photos of treated zones.

Asset transport – A skip-bin rental company in WA tracks bins with Bluetooth tags and routes pickups through Locate2u.

Fast onboarding – Driver app ready within minutes, intuitive web UI.

Transparent pricing – Flat per vehicle, no hidden message fees.

Dual use – Handles both delivery and appointment scheduling.

Smaller integration list – Fewer direct ERP links than older rivals.

Limited analytics – Simple dashboards, not deep BI.

Trial only, no free tier – After trial, each seat paid; micro fleets must budget.

Free trial. Basic GPS from USD 15 per vehicle per month; full suite with optimisation about USD 52 per seat.

Track-POD suits businesses with ambition and scale. Maybe you have three drivers today, but you'll have a thousand tomorrow. One licence bundles optimisation, live tracking, ePOD, rich analytics and tight permission controls for multiple depots or teams. It copes with city congestion, rural blackspots and complex branch networks without extra plug-ins.

Detrack works best for small crews that need basic tracking and proof of delivery at the lowest monthly cost. The Pro plan starts at USD 29 per driver. Route optimisation appears only in the Advanced tier (USD 39) and on-the-fly route edits are limited, but setup is fast and the interface stays lightweight.

Radaro shines when customer experience is the brand. Enterprise fleets that want white-label maps, live NPS surveys and deep analytics will justify its higher platform fee.

Locate2u slots in for SMEs that juggle deliveries and on-site jobs. Clear seat-based pricing, Shopify sync and an easy dashboard get teams moving quickly, though high-end reporting is lighter.

Still unsure? Launch Track-POD’s seven-day free trial, load real orders and watch optimised routes, live tracking and ePOD go to work—no risk, no credit card. Most teams see time and fuel savings in the first week.

ANZ logistics is unforgiving, but the right software turns chaos into clockwork. Whether you drive one car or manage a national line-haul fleet, modern platforms give you eyes on the road, proof in the cloud and customers cheering for more. Invest in the tool that matches your scale, budget and service promise, then watch on-time delivery and brand reputation climb together.